Chinese Authorities Eye Weaker Yuan Amid Looming Trump Trade Risks

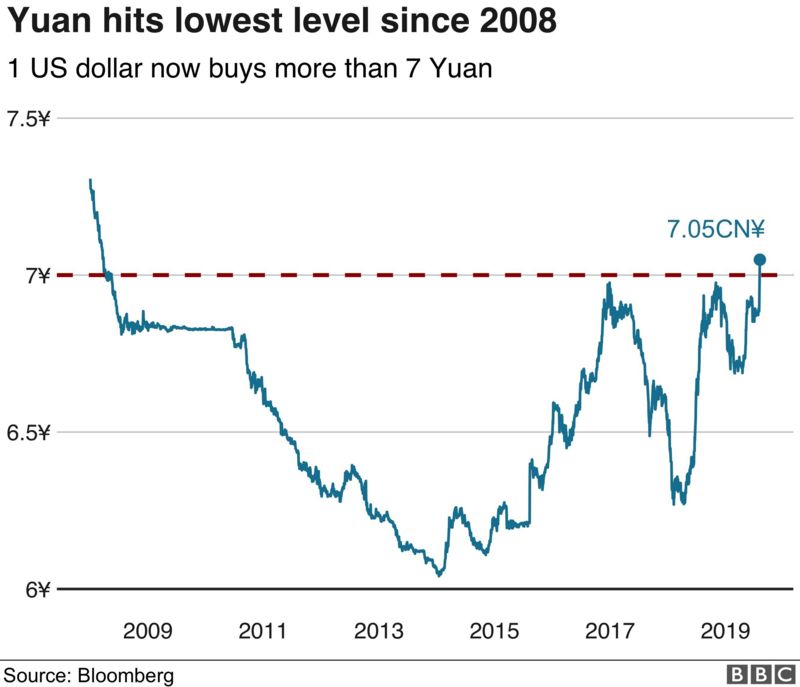

As tensions with the United States escalate over trade, Chinese authorities are reportedly considering allowing the yuan to depreciate in a bid to offset the potential economic impact. This move would represent a significant shift in China’s exchange rate policy, which has been aimed at maintaining a stable yuan for the past several years.

Potential Economic Impact

A weaker yuan would have both positive and negative consequences for the Chinese economy. On the positive side, it would make Chinese exports cheaper, potentially boosting demand and supporting economic growth. This is particularly important given the current global trade slowdown and uncertainty created by the US-China trade dispute.

However, a weaker yuan would also have some negative implications. It would increase the cost of imported goods and services, leading to higher inflation. It could also make it more difficult for Chinese companies to service foreign debt denominated in US dollars.

Perspectives of Key Stakeholders

The potential economic impact of a weaker yuan is a complex issue with differing perspectives among key stakeholders.

Analysis of Credible Sources

A recent article in the Financial Times reported that Chinese authorities are indeed considering allowing the yuan to depreciate. The article cited anonymous sources within the Chinese government, who said that the authorities were concerned about the economic impact of the US trade dispute.

An analysis by the Peterson Institute for International Economics concluded that a 10% depreciation of the yuan would boost Chinese exports by about 2%, but it also warned of the potential inflationary pressures and financial stability risks.

Implications for US-China Trade Relations

A weaker yuan would likely be seen by the US as a sign of China’s unwillingness to negotiate on trade issues. It could further escalate tensions between the two countries and potentially lead to additional tariffs or other retaliatory measures.

However, some analysts argue that a weaker yuan could actually be beneficial to both sides in the long run. By making Chinese exports more competitive, it could help to narrow the US-China trade deficit and reduce trade imbalances.

Conclusion

The Chinese authorities’ decision on whether to allow the yuan to depreciate is a complex one with potentially significant economic and geopolitical implications. While a weaker yuan could provide some short-term economic benefits, it also carries risks that need to be carefully considered. The potential impact on US-China trade relations is another important factor to take into account.

As the US-China trade dispute continues to escalate, the Chinese authorities will need to carefully weigh the costs and benefits of allowing the yuan to depreciate. The decision they make will likely have a profound impact on the global economy.